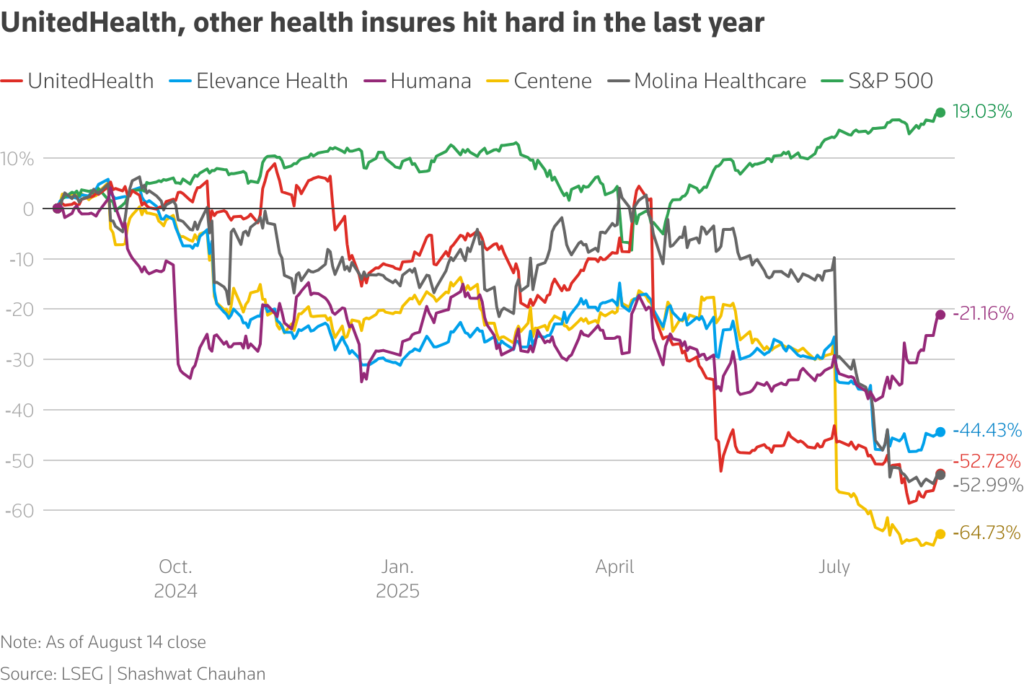

UnitedHealth has had a rough run—facing surging medical costs, a federal billing probe, a cyberattack, and even the tragic death of a top executive. Its earnings outlook was pulled, leadership shifted, and its stock has stumbled nearly 50% this year. Yet when Warren Buffett’s Berkshire Hathaway quietly stepped in with a $1.57 billion purchase of 5 million shares, the reaction was immediate: UnitedHealth stock surged double digits overnight.

This isn’t just another move from a legendary investor; it’s a case study in disciplined opportunity amidst uncertainty. Conservative values prize resilience, not retreat—and buying into a battered but essential industry leader speaks to smart stewardship over speculative frenzy. It’s a reminder that strong institutions matter, even when they appear bruised.

Buffett didn’t act in isolation. His firm also confirmed fresh positions in homebuilders, steel, and security sectors, while trimming its largest holding in Apple. That rebalancing shows a commitment to tangible, real-world value rather than riding tech bubbles. It underscores fiscal responsibility—putting capital behind industries tied to American infrastructure and productivity, not hype.

This also marks a departure from years of conservative caution toward healthcare. Instead of throwing money at statism or retreating from the sector, this choice affirms that reliable, responsible markets can step in when government overreach or instability threatens continuity.

When investor confidence follows principle-backed logic, that’s not just a market signal—it’s a manifesto of how conservative values can guide economic recovery and public trust.