A Minneapolis man has been charged in connection with an alleged Medicaid fraud scheme totaling more than $3 million, a case that state officials say underscores ongoing challenges in monitoring publicly funded healthcare programs. Minnesota Attorney General Keith Ellison filed charges Wednesday against Mohamed Abdirashid Omarxeyd, accusing him of using a state-licensed home health agency to improperly bill Medicaid over several years.

According to Fox News, Omarxeyd faces “eight counts of felony theft by false representation after prosecutors said he used his company, Guardian Home Health Services, to bill Minnesota’s Medicaid program for services that were never provided or were ineligible for reimbursement from 2020 through 2024.” The criminal complaint alleges that Guardian submitted fraudulent claims for a range of services, including “personal care aide services, companion care, homemaking, respite care, individualized home support and other community support services.” State officials have classified many of these services as “‘high-risk’ for fraud,” reflecting the difficulty of verifying care delivered in private homes.

Prosecutors allege that Omarxeyd and his wife siphoned more than $2 million from Guardian’s accounts during the period in question. Court records indicate that Omarxeyd personally received more than $1.4 million from company bank accounts, while his wife received more than $500,000, despite not being listed as an employee or owner of the business. Investigators say the funds were diverted while Medicaid was billed for care that either did not occur or did not qualify for reimbursement under program rules.

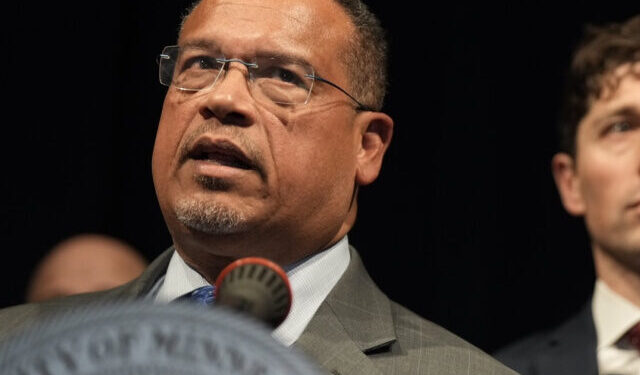

Attorney General Ellison emphasized the broader implications of the case, stating, “Defrauding programs that provide healthcare to low-income Minnesotans is a truly despicable act.” He added, “Since I first took office, my team and I have prosecuted over 300 cases of Medicaid fraud and won over $80 million in restitution and recoveries.” His office has identified healthcare fraud as a recurring issue tied to the scale and complexity of Medicaid, one of the largest public expenditures jointly funded by state and federal taxpayers.

Additional allegations reported by Valley News state that Omarxeyd also paid “workers less than legally required wages while pocketing the difference” and submitted “claims for workers who stated they never provided services.” In one cited example, investigators found that Omarxeyd billed for personal care aide services while the recipient was hospitalized more than 20 times in 2022 and 2023, collecting more than $7,500 for care that could not have been delivered. In another instance, a worker told police she completed an application but never began employment, yet Omarxeyd allegedly submitted claims showing she provided up to 11.5 hours of daily services, resulting in Medicaid paying Guardian more than $11,000.

The case unfolds amid broader concerns about fraud across publicly funded assistance programs. In December of last year, Assistant U.S. Attorney Joseph Thompson disclosed that half of $18 billion in federal welfare funds supporting 14 Minnesota-run programs since 2018 has been lost to fraud. “Minnesota has become a magnet for fraud, so much so that we have developed a fraud tourism industry — people coming to our state purely to exploit and defraud its programs,” Thompson said. “This is a deeply unsettling reality that all Minnesotans should understand.” His remarks highlight the scale of losses that can occur when oversight mechanisms fail to keep pace with expanding program spending.

The charges against Omarxeyd are allegations, and the case will proceed through the court system. State and federal officials say investigations like this one are part of ongoing efforts to strengthen accountability, protect public resources, and ensure that assistance programs function as intended for eligible recipients.